News & Media

ABS-CBN NEWS ONLINE: Megaworld seeks approval of P27.3B real estate investment trust offering

Published on June 16, 2021

MANILA - Megaworld Corp on Wednesday said its unit MREIT Inc has submitted a registration statement with the Securities and Exchange Commission for its real estate investment trust (REIT) initial public offering.

MREIT plans to offer secondary shares of up to 1.239 billion common shares at P22 per share. It is expecting to raise up to P27.3 billion, with an overallotment option, the company said in a disclosure to the stock exchange.

The total, assuming full exercise of the overallotment option, "would be the biggest REIT offering in the Philippines to date," Megaworld said.

Megaworld said it intends to reinvest the proceeds in 16 projects all over the country.

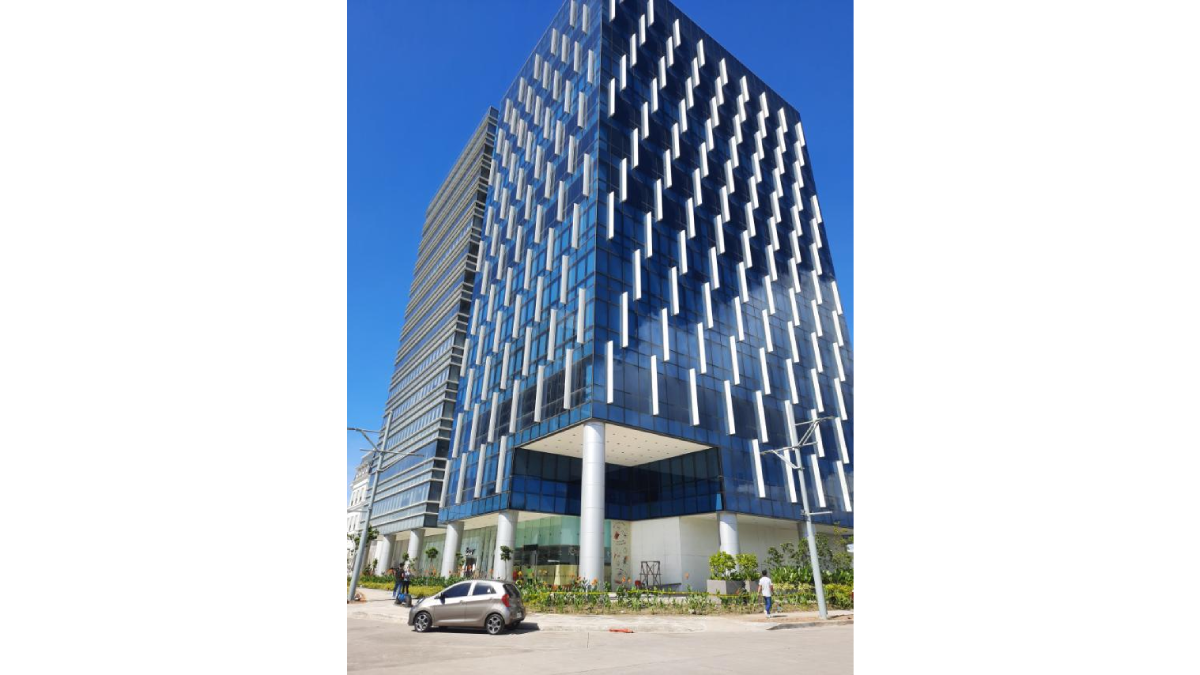

The company injected into MREIT 10 office, retail and hotel assets within 3 of its townships with a leasable area of 224,430.80 square meters through a share-swap, it said.

REIT is a new investment channel that allows investors to engage in the real estate sector through dividends.

“We intend to be the largest REIT by portfolio in Southeast Asia,” said Megaworld chief strategy officer Kevin Tan.

Tan said its REIT offering is different since properties are focused on townships where tenants pay premium rent for township lifestyle.

Townships, which have food outlets, medical facilities, outdoor spaces as well as condos, hotels and dorms, are “incredibly efficient” model that has attracted over 200 BPO clients so far, he said.

“We’re packaging entire ecosystem into the REIT, which makes it special, very different. During pandemic - township model really elevated itself,” Tan said.

Megaworld, the Andrew Tan-led company, currently has a portfolio of leasable spaces with around 1.4 million SQM of office property in 10 major cities in the country.

Ayala Land’s AREIT and DoubleDragon's DDMP are listed in the stock exchange. Robinsons Land is also seeking approval of its REITs offering.

Related News

May 13, 2024

MREIT to acquire six assets worth P13.15-B

February 29, 2024

MREIT's distributable income surges to P2.8B, up by 13%

November 7, 2023